- Quotes from modified car specialists

- Cover options for declared vehicle modifications

- Options for performance and cosmetic upgrades

- Compare specialist quotes with one quick form

We partner with specialist insurance providers including

Why QuoteSearcher for Modified Car Insurance?

Many drivers modify their cars to enhance performance or personalise the look and feel of their vehicle. Anything that differs from the factory specification, such as upgraded suspension, custom alloys, performance tuning, or cosmetic changes, for example, may count as a modification, and this could influence how insurers assess risk.

Because modified vehicles are often more complex to insure, many drivers prefer speaking with brokers familiar with how different modifications can affect insurance considerations. By completing our short form, you’ll be connected with specialists who regularly arrange cover for modified cars and can discuss the options available based on your vehicle and its upgrades.

Customer's Love Our Service

Quick quote, no hassle and saved £700!

Fantastic can't fault in any way, would use time and again and recommend to all!

Excellent and fast service, will use again.

Quick helpful and cheap, can’t complain at anything. Thanks very much.

Found the site easy to use, had good feedback from four companies, all very competitive.

Helpful and efficient service, I was impressed how quickly I received my quotes.

Very quick responses and completed selection and purchase of a very competitive new policy within 24 hours.

Very good and easy to use, this has not only saved me money but also saved me a lot of phone calls and time, thank you.

Excellent service and delivered quicker than the website said. Have bought and will buy much more from here. Prices very competitive and often much cheaper. Yet to find something I want that they don't have.

Thought they were very good there was no need to ring around and I found what I was looking for.

Modified Car Insurance Policy Features

Depending on the provider’s terms and your vehicle setup, a modified car policy may include:

Agreed Value Cover

Some brokers may outline policies where the vehicle is insured for an agreed amount rather than its market value. Learn more about Agreed Value Cover. Learn more about Agreed Value Cover.

Laid Up Cover

Potential options for cars undergoing repairs, restoration, or additional modifications. Learn more about Laid Up Cover.

Breakdown Cover

Some policies may include roadside assistance, recovery, or onward travel.Find out more about Breakdown Cover.

Limited Mileage

If you only drive your modified car occasionally, certain providers may offer mileage-based policies.Read more about Limited Mileage Cover.

Windscreen and Glass Cover

Options for repairing or replacing windscreens and vehicle glass.Learn more about Glass and Windscreen Cover.

Track Day/Rally Cover

Some brokers may explore specialist cover for approved track or rally events.

Types of Modifications

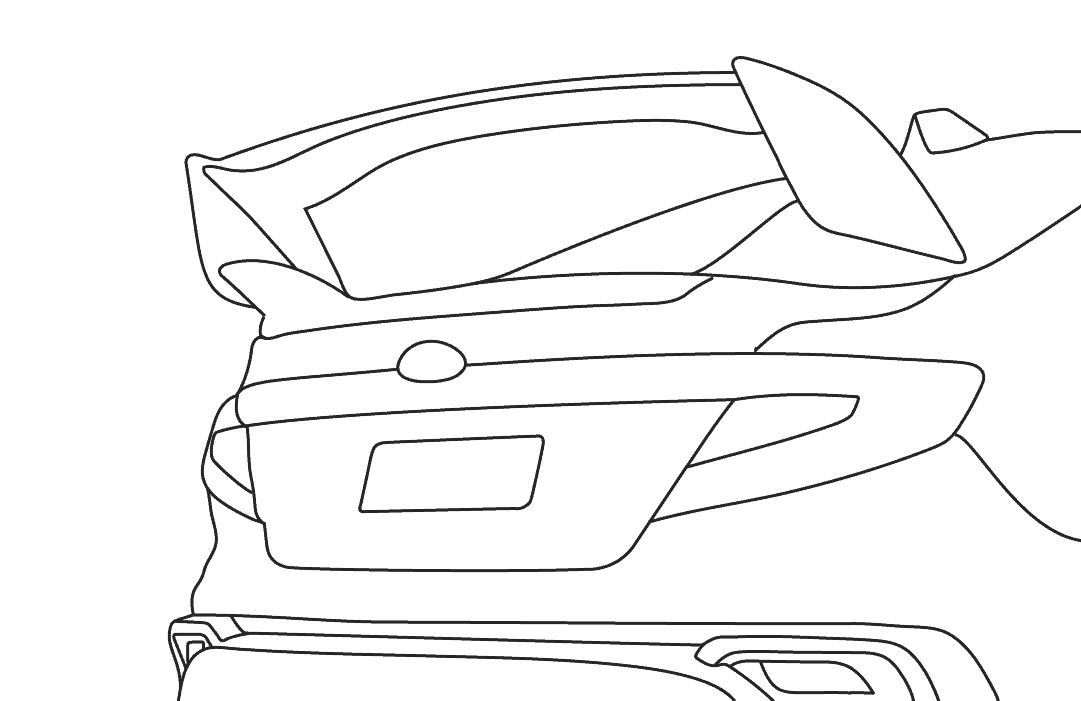

There are many modifications you could choose to make to your car, each one bringing something new to the vehicle in terms of power or aesthetics. Any changes from the manufacturer standard are considered to be modifications, including the following changes:

- Turbo/supercharging

- Transmission or gears

- Exhaust

- Wheel arches

- Lights

- Windows

- Spoilers/skirts

- Roll cages/bars

- Suspension

- Dashboard

- Specialised paintwork/stripes

There are many other modifications that can be made, but this is a small selection of changes that end up costing you more in terms of your premium. You need to tell your insurance broker if there have been any modifications made to your car otherwise your policy may be invalidated.

How Much Does Modified Car Insurance Cost?

Insuring a modified car can be more expensive than insuring a standard vehicle. Modifications may alter how the car performs, how much it is worth, and how appealing it is to thieves – all factors that could affect how providers assess risk.

Some upgrades, such as added security systems or parking sensors, may help reduce your premium with some providers. However, performance-enhancing changes often increase costs.

Your premium will depend on the make and model of your car and the nature of its modifications. Brokers who specialise in modified vehicles can help you explore policy options based on your specific setup.

Factors Affecting Premium Price

Several factors could influence the price of modified car insurance. These may include:

Driver Age

Younger drivers are sometimes associated with higher risk, which could affect premiums, particularly when combined with performance modifications.

Named Driver

Including an experienced named driver, such as a parent or long-term policyholder, may help reduce costs in some circumstances, depending on the provider.

Driving Behaviour

Some providers may offer telematics-based policies, where a black box monitors how safely you drive. Safer driving could sometimes result in lower premiums, depending on insurer criteria.

Vehicle Maintenance & Storage

Keeping your car in a garage, on a driveway, or behind secure access points may help reduce your premium. Additional security, such as alarms or immobilisers, may also be beneficial.

Driver Experience

Certain brokers may recognise advanced driving qualifications such as PassPlus, which could contribute to a lower price with some providers.

Make & Model of the Vehicle

As with all car insurance, your car’s insurance group (1–50) affects the cost of cover. High-performance or rare models usually fall into higher groups.